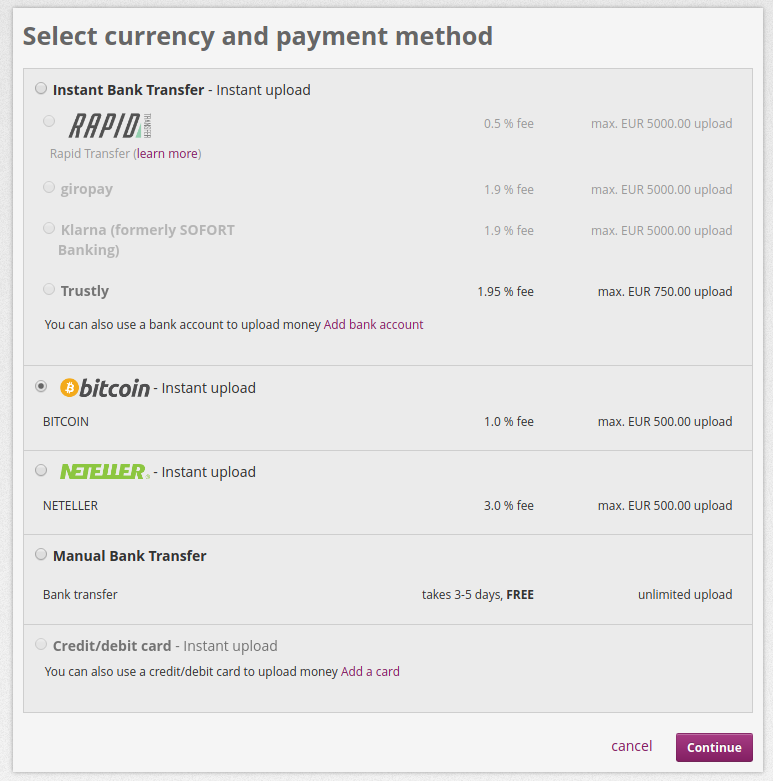

This, indeed, allows for a faster and more flexible payment procedure with decent transaction fees charged by the debit card service providers.

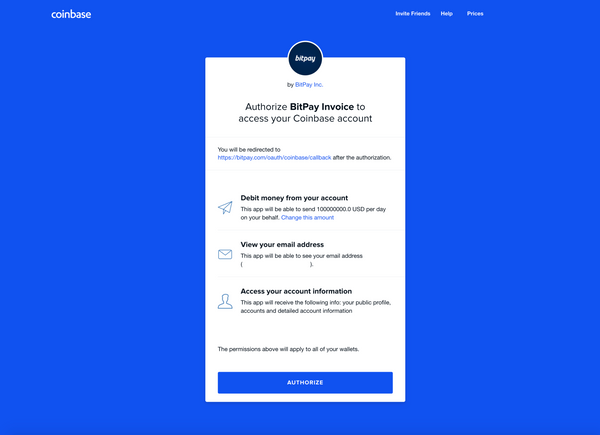

The second type of cards is a bit more interesting one, because it introduces an automated exchange system operating independently and requiring no actual involvement from the user. So once you get your card, it will already have real money on it, so, technically, you are going to deal with a more or less traditional card payment system. converts your crypto-coins to fiat money and puts them on your account.The first type of cards is more of a pseudo-cryptocurrency one, as you only need your crypto-coins to be paid directly to your service provider that: So far, there are two types of cryptocurrency cards available: This has been done primarily because there are currently no effective POS systems that would support digital currency payments, nor there are enough businesses that would be interested in providing their ventures with those systems. However, the actual transactions can be possible only through converting cryptocurrencies into a corresponding fiat currency. These cards are also issued by already existing international payment systems, such as Visa or MasterCard, which makes it possible to use them with any point-of-sale terminal around the world. The only difference is that you can store cryptocurrency on them. 5 Ethereum / Multi-currency debit card servicesĬryptocurrency debit cards look exactly like traditional debit cards.3 Advantages of cryptocurrency debit cards.2.2 Alternative (off-chain) transaction processing.2.1 Traditional blockchain transaction processing.2 Cryptocurrency debit card transaction processing.In addition, here you will find a list of the best cryptocurrency debit card services that can be used by Bitcoin and Ether holders with some of them supporting alternative coins as well. In this post, we will tell you about the specifics of cryptocurrency debit cards and how they solve the problem of lengthy blockchain transaction processing, among many others. This is one of the main reasons why cryptocurrency debit card services are emerging. Thus, adapting cryptocurrencies for real-world transactions can essentially simplify a payment routine for those willing to spend their crypto-coins in a more traditional way. Many people would like to be able to use their bitcoins or other digital currency when going out for groceries or visiting restaurants on a daily basis.

Today, when we have to face the unprecedented outburst of popularity of cryptocoins across the world, there is a strong need for providing cryptocurrencies with a way to be used in people’s everyday life.Įxchanging bitcoins or ether to fiat money in order to be able to spend them was initially a good idea, but the digital currency becomes more and more valuable every day, making it less practical to be exchanged for an immediate use. Some people remained skeptical as to whether the ecosystem will grow enough to compete with traditional currency, while others believed that the future worldwide economy would not only manage to adapt digital currencies, but would also provide all the necessary conditions to completely digitalize the whole monetary system. Since the day cryptocurrencies came into existence, we have been constantly reimagining their practical real-life application.

0 kommentar(er)

0 kommentar(er)